The Main Principles Of Hsmb Advisory Llc

Table of Contents6 Simple Techniques For Hsmb Advisory LlcWhat Does Hsmb Advisory Llc Mean?Hsmb Advisory Llc Things To Know Before You BuyThe smart Trick of Hsmb Advisory Llc That Nobody is DiscussingThe Buzz on Hsmb Advisory LlcThe 45-Second Trick For Hsmb Advisory Llc

Ford says to steer clear of "cash value or long-term" life insurance policy, which is more of an investment than an insurance coverage. "Those are very complicated, come with high compensations, and 9 out of 10 people do not require them. They're oversold because insurance policy representatives make the biggest compensations on these," he claims.

Special needs insurance policy can be costly, however. And for those that go with long-lasting treatment insurance policy, this policy may make handicap insurance coverage unneeded. Learn more regarding lasting care insurance coverage and whether it's best for you in the following area. Long-lasting treatment insurance policy can assist spend for expenditures connected with long-term treatment as we age.

Hsmb Advisory Llc Things To Know Before You Buy

If you have a persistent health and wellness issue, this kind of insurance can wind up being vital (Life Insurance). Don't let it worry you or your financial institution account early in lifeit's usually best to take out a policy in your 50s or 60s with the anticipation that you will not be utilizing it till your 70s or later on.

If you're a small-business owner, consider protecting your resources by buying business insurance. In case of a disaster-related closure or duration of rebuilding, business insurance coverage can cover your income loss. Think about if a considerable weather occasion impacted your shop or production facilityhow would that influence your income? And for exactly how lengthy? According to a record by FEMA, between 4060% of small companies never ever resume their doors adhering to a catastrophe.

Plus, using insurance can occasionally set you back even more than it saves in the long run. If you get a chip in your windshield, you might consider covering the repair work expenditure with your emergency savings rather of your automobile insurance. Insurance Advisors.

5 Easy Facts About Hsmb Advisory Llc Shown

Share these pointers to secure liked ones from being both underinsured and overinsuredand seek advice from with a relied on expert when needed. (https://canvas.instructure.com/eportfolios/2754178/Home/Health_Insurance_St_Petersburg_FL_Tailored_Solutions)

Insurance that is purchased by a specific for single-person insurance coverage or protection of a family members. The individual pays the premium, as opposed to employer-based medical insurance where the company often pays a share of the costs. Individuals may look for and purchase insurance coverage from any kind of plans offered in the individual's geographical area.

Individuals and households might qualify for economic assistance to decrease the cost of insurance premiums and out-of-pocket expenses, but only when registering via Connect for Wellness Colorado. If you experience specific changes in your life,, you are qualified for a 60-day duration of time where you can enlist in a specific strategy, also if it is outside of the yearly open registration period of Nov.

15.

It might seem basic however understanding insurance index policy kinds can additionally be confusing. Much of this complication comes from the insurance policy industry's ongoing objective to create personalized coverage for insurance policy holders. In creating adaptable policies, there are a range to pick fromand every one of those insurance policy types can make it hard to recognize what a certain policy is and does.

Facts About Hsmb Advisory Llc Revealed

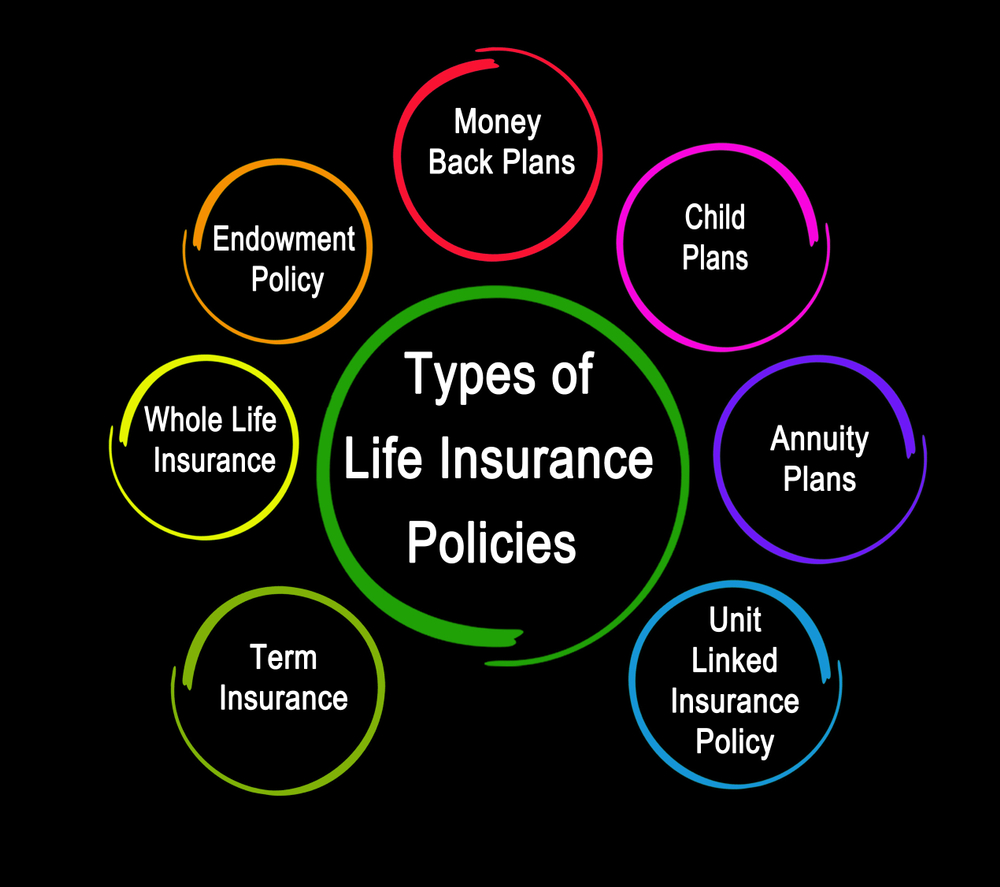

The most effective place to start is to discuss the distinction in between both kinds of basic life insurance policy: term life insurance and permanent life insurance policy. Term life insurance policy is life insurance policy that is just active temporarily period. If you pass away throughout this period, the individual or individuals you've named as recipients may get the cash payout of the policy.

Many term life insurance coverage plans let you transform them to an entire life insurance plan, so you don't shed protection. Typically, term life insurance coverage policy costs settlements (what you pay per month or year into your policy) are not secured at the time of acquisition, so every five or 10 years you have the plan, your premiums could climb.

They likewise have a tendency to be more affordable general than whole life, unless you acquire an entire life insurance policy plan when you're young. There are additionally a couple of variants on term life insurance policy. One, called group term life insurance policy, is common among insurance coverage alternatives you might have access to with your company.

Examine This Report on Hsmb Advisory Llc

This is usually done at no cost to the employee, with the capability to acquire added protection that's secured of the worker's paycheck. Another variant that you could have accessibility to through your employer is supplemental life insurance policy (St Petersburg, FL Health Insurance). Supplemental life insurance policy might include unintended fatality and dismemberment (AD&D) insurance, or interment insuranceadditional protection that could assist your family in instance something unanticipated happens to you.

Permanent life insurance just refers to any kind of life insurance policy that doesn't end.